A conversation with Brigidine elders about the future, with 15 minutes of mindful movements at the beginning. This special event took place on 1 February 2024 when we enjoyed an open conversation with 3,000 years of life experience. As you will hear, we approached the opportunity with some references, including elements of our recent timescape …

Continue reading “I Want A Revolution”

Book of Leaves – a big picture story

Ceara knows things aren’t right, that they can be better for everyone. Like most, she doesn’t have all the answers. But she’s courageous and takes a step in the right direction. She contributes to the emerging future by sharing her passion with thousands of listeners from all walks of life around the world. She curates …

Continue reading Book of Leaves – a big picture story

Faith, Hope and Charity – harbingers of doom

Malta, a small archipelago in the centre of the Mediterranean, has played a pivotal role in the commerce and politics of Europe, Africa and Asia since people travelled across that sea. In the Second World War, as a British colony, Malta was of critical strategic importance to the Allied forces while the right wing military …

Continue reading Faith, Hope and Charity – harbingers of doom

What is a system change entrepreneur? : in conversation with KCLR

KCLR’s spoke with us for their Ours to Protect series. In November, KCLR producer Ethna Quirke spoke to Tom Butler about his retreat from the corporate world, a return to nature and his work with the Carlow County Environmental Network and their upcoming “Feast upon the Earth” event. The programme was released in two broadcasts: …

Continue reading What is a system change entrepreneur? : in conversation with KCLR

Feast Upon The Earth – The Book

Back in April when we sat down to brainstorm over a coffee and dreamed up an installation exploring the human relationship with nature we had no idea it would lead to such wide insights and wonderful feedback from visitors. Feast Upon The Earth was a powerful experience and the resulting timescape brought out new understanding …

Continue reading Feast Upon The Earth – The Book

Why worry about system collapse?

“Why worry about capitalism when the earth is a pointless ball of shit?” Is this really a question? Well they had a panel… In this clip a way out of the mess is offered, in case you think life is worth living. As for “pointlessness”, it’d be normal if you thought there is no meaning …

Continue reading Why worry about system collapse?

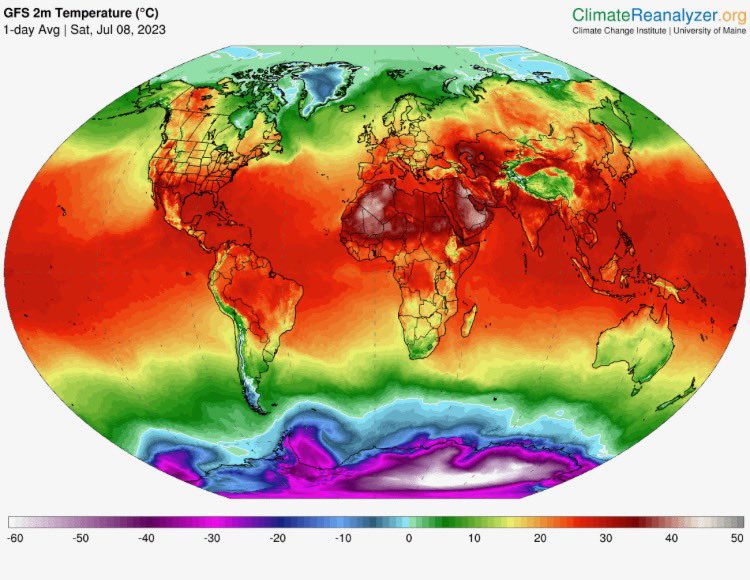

The Death of Life

“This frigid sea was a speckled mass of organisms. Tiny copepod crustaceans, looking like so many animated peas, beat their way in their thousands through the surface waters, feeding on plankton that I knew must be there, but which could not be seen without a microscope.” That picture of vitality in the Arctic begins the …

Continue reading The Death of Life

We’re at IMMA’s Earth Rising Festival in September!

Astraea will exhibit at IMMA’s Earth Rising festival this September. IMMA welcomed people from all walks of life for this 4-day event that invites “eco related programming showcasing the most exciting innovators in the field of eco citizen science, design & creativity, empowering audiences to become agents of change.” That’s us! Our installation Feast Upon …

Continue reading We’re at IMMA’s Earth Rising Festival in September!

Waking up to System Collapse

As the dawn crept through the curtains this morning, my dreamy thoughts recalled the gathering of people who had listened to Jem Bendell talking about his new book Breaking Together yesterday evening. It occurred that we could have had it all but, as I had known for some years now, that opportunity had passed. And …

Continue reading Waking up to System Collapse