The Long Term

We’re talking 20 years or so here.

In 20 years we’ll be facing Big Stuff. Climate change, weather volatility, species loss, clean air, clean water, … that whole environment thing will be getting much more serious and everyone will be dealing with it in some way or another. I’m hoping it’ll make Ireland a bit more like the south of France, and it might, but whatever else, it’s going to make the simple things in life more difficult. For most of humanity that will include feeding themselves and getting clean water.

So that will make food and land more important.

In 20 years we may well have passed “The Singularity“. That’s a term coined by futurists, often with a trans-humanist bent, which denotes the inevitable point at which technology development starts happening “by itself”. This occurs as humanity’s understanding of physics and biology enable the creation of thinking machines (computers) that emulate the brain, and then androids and cyborgs begin to be used in place of people.

Certainly in 20 years technology will have changed our world even more than in the past 20. Do not imagine The Singularity to be fantasy. We are close already. The mobile phone/computer in your pocket is old technology compared with neuro-computers being tested in laboratories. Robots are already becoming remarkably similar to C-3PO in looks and mobility at least. Today the consequences are being felt in most professions as AI (artificial intelligence) takes jobs away from humans. This is what we all wanted – automatic checkout, automatic cashier, automatic accountant, automatic lawyer, automatic vehicle … The challenge now being solved is automatic creativity.

If the tech-pioneers succeed there will be no need to work. The consequences haven’t been considered because policy-makers are barely aware of the possibility, let alone the reality that it is just around the corner. The consequence of automation today, which is growing at an exponential rate, is already unemployment and a widening gap between those with capital and those without. Those with capital accumulate more, those without are consigned to menial jobs which a robot can not yet do. Yet the population continues to grow.

Isn’t it ironic that these two likely trends of civilisation’s development seem at odds: the creation of virtual humans when food systems, and our biosphere, are failing. The manifestation of these paths is simply a consequence of how we choose to spend our

resources. High energy consumption and the dehumanisation of humanity through automation causes the breakdown of the natural systems and, it seems, our human systems of civilisation.

The Medium Term

That’s up to you. Your behaviour, and mine, and his and hers, determine the world created. We are all connected. We are influenced by one another. We rely upon one another for everything. We choose.

At some point soon, the choice for growth must change. This is a fundamental change in the global order. Money systems are tied to growth. Political systems, including religion, are tied to growth. But there is no more room for growth. The planet long ago exceeded it’s capacity to provide for all humans – there are too many of us. While initiatives like The Venus Project and The Zeitgeist Movement point to the opportunities of abundance, which there are, there is little realistic recognition of the need for individual behaviour to mature in order to effect system enlightenment and manifest the opportunities presented by technology.

The reality is that limits have been reached and we continue to deceive ourselves that we can continue playing the same game of growth. We can not. The limits to growth have been exceeded, many times over. As the original authors of the Limits to Growth study noted: there will be a “sudden and uncontrollable decline in both population and industrial capacity”.

The reality is that limits have been reached and we continue to deceive ourselves that we can continue playing the same game of growth. We can not. The limits to growth have been exceeded, many times over. As the original authors of the Limits to Growth study noted: there will be a “sudden and uncontrollable decline in both population and industrial capacity”.

But we must still operate in the system that brought us here, until and while it changes. The alternative is chaotic implosion. If you yearn for that change, the answers are generally common sense. They involve choosing a world which reflects human values of love and sharing. It means not cheating. It means not accepting tradition and mantra without thought. It means thinking about the choices you make – the food you eat, the waste you create, the pain you inflict by your own consumption pattern, the opportunities you have to slow down and live. It means pursuing a quality of life measured in more than just money. Money doesn’t always reveal the value or cost of health, knowledge, security, shelter, or simple human dignity. It certainly doesn’t if it’s not measured and “income” does not measure health or dignity.

The world of money has disconnected us from the real world because of a fundamental driver of “growth”: debt. Some people actually equate money with debt because it is debt that is used to create new money. This is the “fractional reserve banking system”. A fraction (say 90%) of a deposit is lent by a bank, thus the amount of “money” becomes the deposit plus the loan, ie 190% of the deposit. The loan could then be deposited and another loan made upon that so that the amount of money becomes 100%+90%+(90% of 90%) or 271%. And on and on … And then there are credit cards …

The Short Term

So, let’s talk about money. It’s not that life is about money, but these days money is what you use to choose, to choose your life and ours. The more money, the more you choose, even if that choice is to do nothing.

Money means credit and stock markets, property, land, assets, it means how you live, work and play. Well, up to a point anyway. And if there’s a lot of money in your life, then this is more relevant for you.

The short term outlook is volatile. There are significant risks which are influencing markets but which are not easy to analyse. Political risk is illustrated by the unusually diverse progression of elections in the US (the world’s largest economy), by the continuing pressure of emigration from war torn states like Syria, by the latent threat of terror from fringe groups like ISIS/ISIL. These are on top of the long term threats from violence in and around Israel, North Korea, Afghanistan, Iraq. The saddest, yet unrecognised political risk, is the unwillingness of incumbent institutions and players to change. People clearly want greater manifestation of democracy, but the system has failed to adapt to the demands of popular unrest. This is well illustrated by the popularity of Trump and Sanders in the US Presidential race or Corbyn in the UK, who stand simply for change.

Economic risks have been noted by media for some months now. The Economist proclaimed on their cover back in mid-2015 “Watch Out – The world is not ready for the next recession” and now are reiterating the analysis that “The World Economy [is] Out of Ammo?“. Analysts point to limited fundamental growth, decreasing capacity for growth especially as China slows, rich stock market valuations, deflationary pressures, and continuing structural inefficiencies in the financial system as debt burdens increase to Financial Crisis levels.

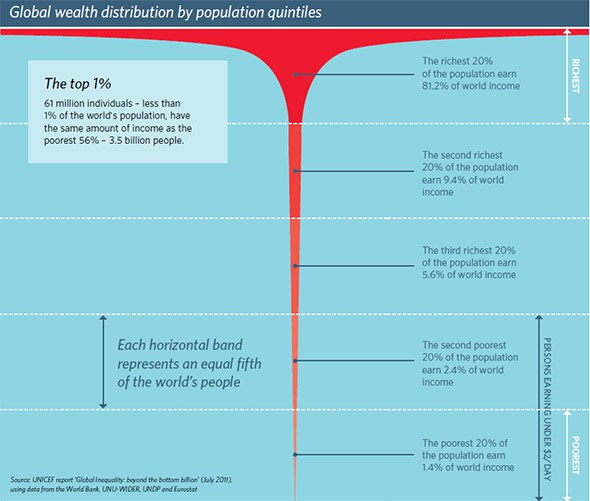

In January, as the rich gathered for the World Economic Forum at Davos in the Swiss alps, Oxfam released its review of how the wealth of the poorer half of the world’s people equates to the wealth of a few of the world’s richest. In 2016, that “few” dropped to 62 people from 80 in 2015. Their study by Credit Suisse reckons the wealth of the richest 1% now equals that of the other 99%. Whatever qualifications you apply to the accounting of wealth or income, it is beyond doubt that the wealth divide is large and growing. This is the trend mentioned above in which those with capital accrue more, and those without don’t.

The rich are getting richer more quickly than the poor are attaining subsistence. The richest are getting richer fastest. In America, research shows that the richest 0.01% (about 16,000 households, with average wealth in 2012 of $371m) own 11% of the wealth compared with 2% in 1979). The richest 0.1% households own 22% (in 2012, up from 7% in 1979). That pattern is repeated globally.

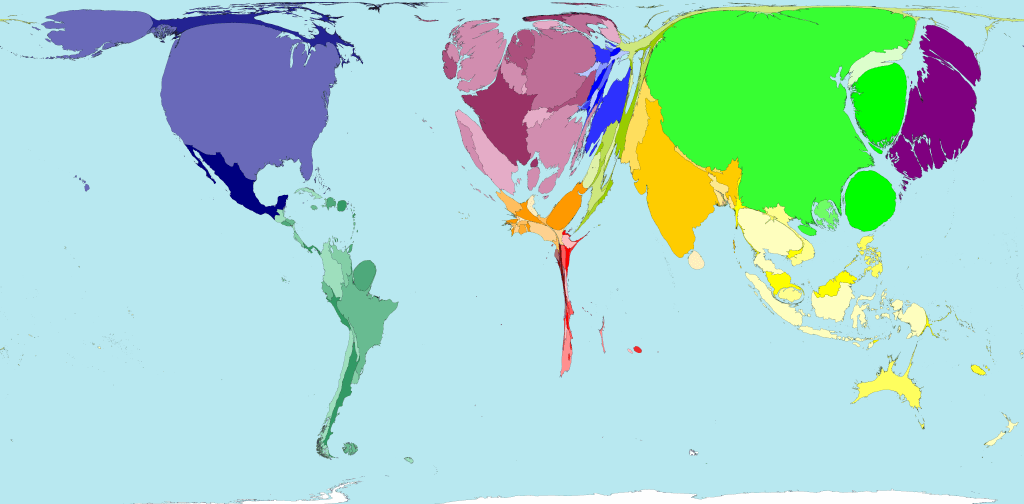

These images help illustrate the situation. The inverted pyramid in red shows pretty much all the wealth (in red) possessed by the top quintile of people. The distorted world map represents the GDP (not wealth but a fair proxy) of countries by area – it’s weird to see Africa, South America and Eastern Europe disappear …

| Global wealth distribution by quintiles

|

Countries’ area scaled to income

|

Fortunately there are signs of empathy among the elite. Recently Mark Zuckerberg and Priscilla Chan promised most of their wealth to charity. That is in the admirable vein of Buffet and Gates and it should be so, even if they will not feel it. It might even be a relief not having to worry about the billions. They will survive – the 1% they will retain is worth nearly half a billion dollars. That is 400 times the lifetime income of the median college graduate! Their generosity is further evidence of worryingly unequal distribution of wealth, but gives some hope that some wealthy people have empathy and might encourage system change.

This extreme wealth distribution – little for most and much for few – highlights the lack of fairness in the sharing of earth’s resources and the need for those at the top to engage with the challenges of the 21st century, namely making life dignified for all people, and not destroying the biosphere as we know it.

The stress of the dysfunctional system is now threatening modern civilisation. In the same way that decadence brought down the Roman empire, we are jeopardising our immediate future, but on a global scale. It is difficult not to see the signs, but it is rather too easy to ignore them.

Before we go further, let’s be clear that this is not an attempt to berate or vilify wealthy people. It is not a cry for equality. It is not a call to point at them, while ignoring us, or vice versa. The only way out of this mess is up and that means higher values. They do not include envy, jealously, greed, acquisitiveness. They do include philanthropy. And they must include freedom, including freedom to choose. So, if you’re in the top 1% (e.g. you own an average house in London without a mortgage) that’s OK. You might not even feel that well off as you look at school fees and the cost of a holiday in the sun. But everyone reading this is in the top 10% and has the enlightened thinking to comprehend that the system is not working as it should, and can understand that there is a better way.

So without demanding that everyone put on a grey Mao suit and be equal, let’s look at what choices can be made with our money.

Clearly the modern money system is far better than bartering clam shells, however an increasing number of people believe it has got out of hand. The resilience of the financial system relies upon trust. The Global Financial Crisis was precipitated by a justifiable breakdown in trust, as everyone realised that even the experts had lost touch with the reality of sub-prime derivative instruments. Today the level of debt on national, corporate and personal balance sheets is rising to levels reminiscent of those in the noughties. Observers have long derided the lack of retribution paid to the financial elites who allowed the money pyramid to grow beyond sustainable levels, with its inevitable crash. The system has barely improved. While there is talk of better compliance and KYC (know your customer), action is directed to money laundering and criminal cartels rather than reining in profligate banking policy and pyramids of pay. The moral compass has not improved and data suggests an unsustainable financial bubble is swelling.

On a more mundane note, the financial system is exhausted, globally. It is important to remember that the globalisation of economies means that all economies rise and fall on the same swells. The interconnectedness is becoming more entrenched and can not be undone – money is fungible globally, technology is global, people are the same all over the world and want the same things. And the financial system is extended. Interest rates are low and will remain so as stimulus policies continue to strive for growth. The effectiveness of low interest rates has been dulled by banking regulation and aggressive lending margins so that borrowing is not as attractive as it should be. The ability to stimulate growth by printing money is dulled because everyone is doing it, so inflation ensues. Printing money is helpful when it used to create jobs, but is wasted when done inefficiently or unsustainably. As has been said before, spending on infrastructure and education is a good use of public money and both areas would benefit from rejuvenation: Transport infrastructure to improve public facilities helps everyone and is progressive. Education systems are yearning to be improved, but the improvements will transform the industry as it is clear that enlightened, effective learning systems need fewer teachers.

An often ignored harbinger of trouble is the insurance industry, in particular pensions. This financial service and the assets it manages are a significant part of the financial system, yet few of us pay the industry much attention. If we did there would be much greater concern about the strength of financial systems. The problem here is the fundamental disconnect between the returns promised to pension holders and the performance of the asset portfolios of insurers. The projected required funds continue to outstrip returns from the pension assets, and in a low interest rate environment as we have today, that gap is likely to widen exponentially. Some attempt might be made to pad risk insurance premia to bolster returns, but this is not appropriate and will not solve the problem while it exposes underwriters to prosecution. This large and growing funding gap does not even address the exposure of insurers to natural risks. In general it appears that products have been sold on delusional projections which can not be sustained much longer. There will be disruption in the industry, with inevitable consolidation, and the funding gap puts additional pressure on trust in the global financial system. As with the political system, the incumbents of the financial system are loathe to own up and seek sustainable solutions.

While not considered part of the financial system, energy is clearly a key driver of economic metrics. So let’s be blunt: fossil fuels are a tool of the rich and are killing the planet. There is a direct correlation between fossil fuel consumption and wealth, and wealth correlates with pollution and degradation of natural systems. At the extreme of environmental catastrophe it is evident that continued consumption of fossil fuel will break the planet’s biosystem in very few years. Some experts like James Lovelock have stated flatly that it is too late to avoid natural disaster. This addiction to oil, plastic and waste begotten of a consumption culture will be the hardest to change. Few people have even considered the bounty that we consume and the ramifications of having a sustainable energy system, using today’s technology. Comprehension of the change required is made so difficult by the magnitude of the numbers, like the amount of energy consumed to bring us simple pleasures, like tomatoes in winter. But it is possible to have luxuries and happiness without plastic wrap on all our food. It is possible to enjoy a welcome home without enslavement to a machine organisation. It is possible to travel for fun without killing the planet. Here again, the incumbents of the energy system are loathe to change. Why would they want to? They are paid handsomely. But change will come here too as technology improves and spreads, as people choose differently, as regulations become more austere. Will it change quickly enough? Apparently not because climate change is here. Does that mean give up? No. Rather the opposite. It means change more quickly, let go of the addiction and live within nature’s bounty, not beyond it.

So, investment decisions must be made against a backdrop of technology squeezing jobs, intransigent and rather inward looking politics, and an exhausted financial system. People want the bounty of technology, but also the means to pay for it ie jobs, they want political change, in particular a voice in their communities and are fighting to get it and the financial system is benefiting a few at a cost to many.

While the bleak prognosis of experts like Lovelock must be taken seriously, there is some hope. The solutions are available and basically common sense – do the right thing the right way – even if the way they must manifest is unfamiliar – by people choosing to change, rather than top-down direction from government and institutions. Increasingly the choices each of us makes about investing or spending influences the balance between holonic transition to a stable system of global management or a chaotic system failure resulting in a “sudden and uncontrollable decline in both population and industrial capacity” (from Limits To Growth, 1972).

Where to invest?

While the analysis above is not rosy, there are sensible choices to be made, for those with capital and those without. In the first instance remember that your consumption choices are as important as your investment choices, perhaps more so if you have little capital.

If you are blessed with capital, you would be well served to stop for a moment, maybe a day or so, and reflect upon what you want. You’ve probably got most of the things you want already, except perhaps virtual wealth like solace, friendship, equanimity, … These assets are built with the same kind of dedication with which fiscal wealth is accumulated, but, in addition a spiritual dimension is engaged.

So back to money … Where to invest? Simply, look to basic assets and people with skills that are difficult to substitute with technology. Both will increasingly attract value. Little is said about equities here, which is unusual, but perhaps that is because the prospective outlook is risky and demands a cautious approach. The general exception might be investing directly in the equity of businesses, rather than via stock markets.

If you are investing in the stocks, favouring enterprises vested in sustainable technologies are bound to be in increasing demand, but avoid “green wash”. Businesses serving customers with cash should be more resilient, so which are they. Customers for the luxury end of the market are growing, at least at the very top – that is where capital seems to accrue! Businesses that serve the government should be reasonably well insulated, although government finances seem to be under pressure – farmers in Ireland have had their subsidy checks delayed by months. Businesses serving older people should be more resilient because these people have some spending money – their children are on the way out or gone, the mortgage is low or gone and they might even be getting a cheque from teh government. And as always, don’t overpay and avoid transaction costs.

If you’re not a stock picker, and even if you are, the most reliable equity investment vehicles tend to be low load, index linked funds, like those managed by Vanguard and similar outfits. So if you are putting cash in to the stock market to diversify your asset base, consider this approach which has as a fair risk/return profile as any stock picking strategy.

If you’re in the top 0.1% you should be in a position to relax. And leverage is your friend because you can borrow very cheaply and acquire control of earning assets. Ensure your wealth is in low risk, tangible assets, like land, and buy in to enterprises with which you have a sense of affinity and which you can get close enough to to understand. Bear in mind that land needs care, but therein lies the opportunity for regeneration and jobs which enhance the value of your property. You don’t need to be a portfolio investor and putting money in to enterprise instead of brokers commissions and other investors pockets is more worthy. Think about how you could make a difference to your family life, because that will yield high dividends to you. Your personality will influence your decisions greatly, so for example, having a survivor profile will make it difficult to let go. Until you let go, you will continue to strive at the cost of personal relationships and possibly even enjoyment of life. Hedonism has its perks but ultimately yields loneliness which no wealth can compensate. Enter Ebenezer Scrooge … And there is an upside to letting go: It’ll probably all work out well because your successor will be chosen and influenced by you, whether they be offspring or professional.

If you’re in the top 0.1% you are probably also a philanthropist. You can really make a difference here and have fun too. You can make a difference not only in sponsoring good work but in encouraging charitable organisations to operate in a dedicated, frugal manner – no one wants to pay for administration whether it’s government, banks, investment portfolio, business or even charity. Even if you don’t donate to charity, ensuring your business is ethical and devoid of corruption makes the world a better place. Think carefully about what you sponsor and focus on system changing initiatives, like education or infrastructure in poor communities.

If you’re in the top 1%, you probably still need to work. Leverage is likely to be beneficial for you as you can probably borrow cheaply and extend your asset base by enhancing assets or earning equity. You might be able to convert your assets into a low impact lifestyle, building reputation and relationships in a stable community. Otherwise invest in low risk assets underpinned by fundamental demand, like food and property. If you can invest directly in businesses which you understand, consider them. Investment in education will yield, but the world of education is growing up as it transforms from an industrial model to a more nimble, student focussed model enhanced by access to resources via technology, so consider new models in place of traditional institutions. They will always offer a network, but that is not as resilient as skills and attitudes tempered for a less hierarchical world.

If you’re in the top 10%, generating income will become an increasing challenge as technology pushes more jobs to the sidelines. Invest in education for your children and yourself. The most stable employers offer the least exciting jobs so there will be a trade-off between drudgery and liberty. If you can invest, do so close to home, understand the risks and take your time. Your home will be the biggest investment and should prove to be worthy over the long term, unless you overpaid or construction was shoddy. Investing in healthy lifestyles, like clean food, clean air and leisure with friends, will make life more fulfilling and save you health costs as you age.

If you’re in the bottom 90%, pray the system opens up more quickly – praying only takes time and can help (“mind over matter” is scientifically proven). Maintain your integrity and friendships. Grow a few vegetables in the allotment. Avoid junk food, sugary drinks and snacks, media addictions and advertising – they will sap your wits and energy and consume your soul. Play music, sing and dance. That’s what being human is about.

Comments