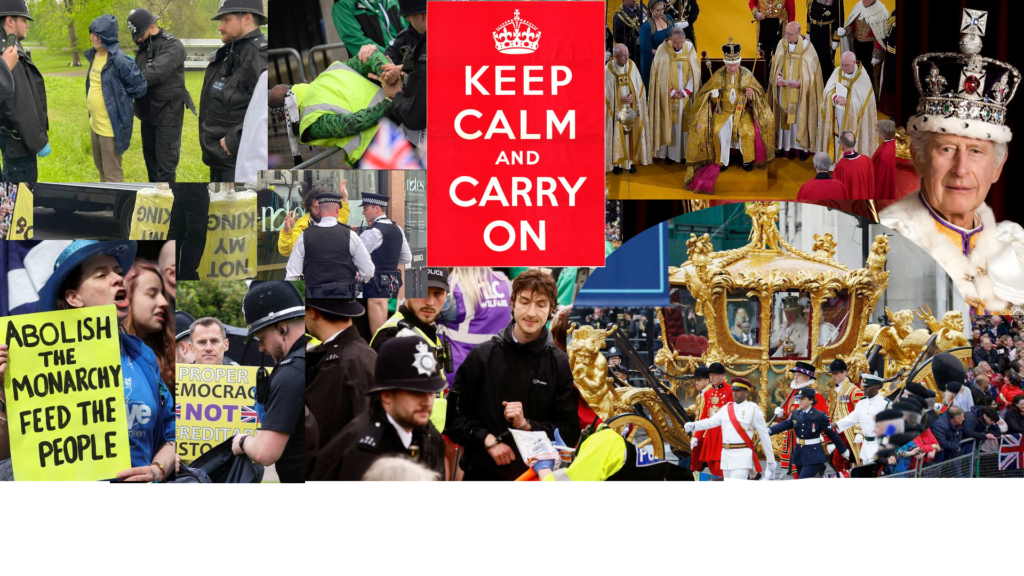

The recent coronation of King Charles in the UK prompted us to reflect on the role of monarchy in our world today. Pam and Tom, one brought up in suburban Canada the other in privileged boarding schools, share their perspectives.

George Floyd murdered. America living in fear of itself. Change is your choice.

It’s still happening. Don’t forget. George Perry Floyd Jr. (October 14, 1973 – May 25, 2020) was an African-American man who was murdered by a police officer in Minneapolis, Minnesota. He is one of many. He would have been 50 this year. Racism is a part of America. The only way to extinguish it, heal …

Continue reading George Floyd murdered. America living in fear of itself. Change is your choice.

The Carlow Butlers

A nice little video of family history focusing on the story from Edmund of Cloughgrennan a rebel for Irish self-determination who collaborated with Fiach McHugh O’Byrne in the 14th century, to one of his current descendants. Thanks to Carlow Toursim who coordinated this production, M Co for filming and editing, Tymandra for narration. More history …

Continue reading The Carlow Butlers

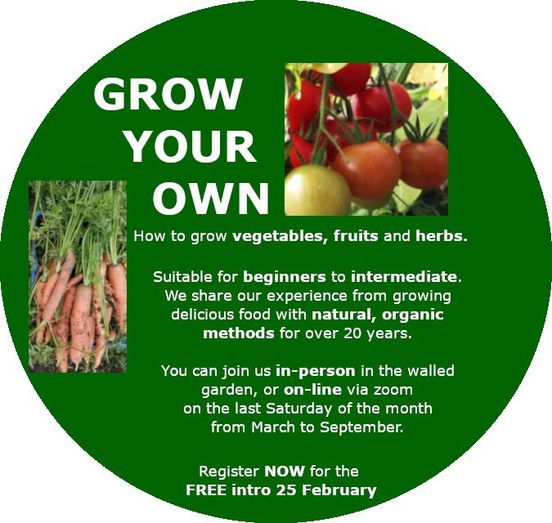

Education, Food, Banking and Grow Your Own: KCLR’s Eimear Ní Bhraonáin talks with Tom

Grow Your Own

A monthly course to help you produce your own healthy food. Here’s a short video of our introductory day in February. Get in touch or book your spot here!

Grow Your Own – introduction

Tom walks around the garden introducing the Grow Your Own course held at Ballin Temple.

Spring Notes: St Brigid, Gardening, Trees, Horse, Furniture Design, History

Spring in Ireland launched with a new festival: St Brigid’s Day! It was a timely reminder of the strength of the feminine and the human sense of justice and care for nature. As you know, we love nature here at Ballin Temple and we took the opportunity to reflect on the changes in Ireland since …

Continue reading Spring Notes: St Brigid, Gardening, Trees, Horse, Furniture Design, History

Reflections on Activism

We attended a protest outside the Irish Parliament to object to the deal that Coillte, a State company, made with a UK venture capital company. In this Big Picture Conversation, we reflect on why we went to the gathering and whether activism works.

Happy St Brigid’s Bank Holiday

Happy St Brigid’s Bank Holiday. It is a great step to establish a holiday to honour Ireland’s matron saint. This is a meaningful day in its recognition of the feminine; an embracing of the qualities of compassion, nature, nurture, inclusion and collaboration that are so urgently needed in the world today; with Brigid’s fire to …

Continue reading Happy St Brigid’s Bank Holiday

Brigit: From Goddess to Saint via the Patriarchy

Happy – and historic – St Brigit*’s Day: Today marks the first time an Irish national holiday is established in honor of a female saint. Why is this important? Establishing a national holiday in Brigit’s name is a recognition of the feminine. Today’s world is run as a patriarchy, or as the late bell hooks …

Continue reading Brigit: From Goddess to Saint via the Patriarchy